The present housing market poses quite a dilemma for buyers and sellers alike. Rising interest rates have many feeling stuck. Would-be buyers are sitting on the sideline in hopes that rates will drop. On the flip side, potential sellers are locked in at favorable mortgage rates with little incentive to sell.

What if there was a way to break this standstill?

Roam’s founder, Raunaq Singh, discovered a hidden gem that can alleviate this problem: assumable mortgages. An assumable mortgage is a type of home loan that allows homebuyers to take over the existing mortgage terms from the seller. Given the low interest rates of previous years, potential buyers can take advantage of these loans and have significant savings over getting a new mortgage.

Roam makes it easier than ever to locate an assumable mortgage. We do the heavy lifting by finding assumable mortgages, then connect potential buyers and sellers on our platform. Now, homeownership is at your fingertips at a fraction of the cost.

Low Mortgage Rates can cut the Cost of Homeownership in Half

Roam is a startup that was founded to solve the home affordability crisis in America and beyond. We believe that assumable loans are the way to do this.

It’s harder than ever for aspiring American homeowners to buy a house. Limited inventory has kept home prices stable, meanwhile rates have skyrocketed from 2% to over 7% in the matter of a year. This combination has resulted in the highest average principal and interest payments on record.

The difference in affordability is staggering when interest rates come down. Roam helps you find low-rate government-backed loans that are assumable. These include VA, USDA, or FHA loans. Let’s look at how it works.

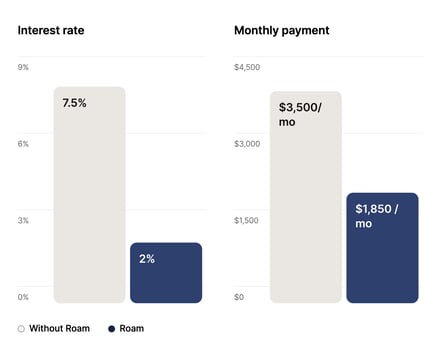

Imagine that the time has come to buy a house and your lender pre-approved you for a mortgage of up to $500,000. At today’s going rate of 7.5% interest, this means your monthly mortgage payment would be about $3,500.

With an assumable mortgage, it’s possible to save up to 50% on monthly payments compared to financing with a traditional mortgage at today’s rates. The same house purchased at 2% interest just a few years ago would be roughly $1,850 per month— a $1,650 savings.

Overtime, assumable mortgages can save you tens of thousands of dollars. The difference can be life-changing.

Roam for Buyers

The best way to save money on your mortgage is by assuming an already existing, low-rate mortgage. This can be complicated without the proper guidance throughout the process. From qualifying to purchasing the home, our team of experts can help you along.

Step 1: Qualification

Before you can start searching for homes, you need to sign up with Roam. When signing up, we will ask questions to get an understanding of factors such as:

- Monthly payment

- Down payment amount

- Geographic preferences

- Eligibility for VA (Veterans Affairs) loans

Entering these criteria will allow our tech to curate houses just for you and remove those that aren’t a fit. For example, if you aren’t VA-eligible, we will filter out listings where the seller requires a VA-eligible buyer to assume their VA loan. While the seller’s current mortgage servicer has the final say to approve the buyer for the loan assumption, Roam provides buyers with information on general eligibility criteria.

We also encourage buyers to ask us questions. It’s our job to help educate you about the process, eligibility requirements, and anything else you want to know.

Step 2: Discovery

Let the house hunting begin! Once you have submitted your qualification criteria and buyer preferences, we start sending you listings. Our recommendation engine allows us to customize viewings for each buyer.

As you begin to explore our platform, you will come across homes that are eligible for assumption. Our listings include pertinent information such as the interest rate, monthly payment, and down payment amount needed.

Step 3: Offer

Before proceeding with an offer, Roam conducts a thorough verification process. We do this to ensure that you meet the general eligibility criteria from a credit and down payment perspective.

There are also additional steps to make sure the process runs as smoothly as possible. Buyers must be prequalified for a mortgage and your real estate agent must have the appropriate documents for mortgage assumption when submitting an offer.

Finally, in the event that you choose to secure a second lien (second mortgage), we’ll help you calculate your savings. Our experts will run the numbers to see how you can achieve the lowest monthly payment based on factors like interest rates and your down payment.

Step 4: Purchase

You found a property you love and decided to buy it.

Once the buyer is ready to sign the purchase agreement, they are also required to sign a Transaction Coordinator Services Agreement with Roam. This agreement entitles Roam to a fee of 1% of the purchase price at closing. Even so, this is typically lower than the closing costs on a traditional mortgage loan.

From there, Roam then files for third-party authorization on your behalf, so we can manage all steps in the process and ensure that the home closes on time.

Roam for Sellers

As the original borrower, one of your greatest assets when the time comes to sell your home is your assumable mortgage. Roam helps you optimize your listing to reach more potential buyers and even advertises the terms of your loan as key selling points. This is how you can find more qualified buyers and receive better offers.

The best part? There’s no contract, no fees, and no obligation to sell their home with a mortgage assumption as part of the transaction. Here’s how it works.

Step 1: Qualification

The first step is to sign up with Roam. It’s important to us that you meet our criteria so that we can help you get the best deal for your home.

We estimate that there are approximately 4.4 million homeowners that meet our criteria. To see if you’re one of them, we need to know a few things about your situation.

- Do you have an assumable mortgage? Typically, an FHA-insured or VA-guaranteed mortgage is assumable.

- Where is your home located? We are expanding to more states, but want to ensure that you live in one of the places where we operate.

- What is your LTV (loan-to-value) ratio? Since buyers need to come up with the funds based on your home equity, using LTV is an affordability measure we use.

- What is your interest rate? Interest rates play a huge role in what a buyer can afford.

| Interest Rate on Assumable Mortgage | Minimum LTV Threshold |

| ≤ 4% | ≥ 50% |

| 4.0 – 5.5% | ≥ 75% |

| > 5.5% | N/A; not Roam qualified |

Step 2: Marketing

Marketing is a crucial part of any home sale. The more people who see your property, the higher the odds of getting a more favorable offer. As the owner of an assumable mortgage, you’re in a unique position. You can use everything from interest rate to how much equity you have in the property as major selling points.

We work with you and your real estate agent to make your home stand out. Roam provides you with two key marketing tools:

- Listing Enhancements. These branded listing images highlight your low interest rate and the fact that it’s assumable in the listing. We also provide suggestions for optimizing the listing description to highlight the affordability benefit of an assumable mortgage.

- Roam Listing Platform. Roam’s listing platform is the only discovery platform for finding homes for sale with an assumable mortgage. The listing will clearly explain the criteria and terms needed to take over your loan. As an added benefit, we filter results so that only eligible buyers can see your listing.

Find more buyers for your listing

Step 3: Buyer Screening

When someone wants to buy a house and assume a mortgage with a low interest rate, Roam steps in to help. We explain to the buyer why this type of mortgage is a good idea and tell them how the process works. That way, there’s transparency from the start.

Then, Roam checks if the buyer is a good fit for this kind of mortgage. They make sure the buyer meets some basic requirements because not all buyers are in the same situation.

Step 4: Purchase

We handle the assumption paperwork when you sell your home. Once a purchase agreement is signed, Roam files for third-party authorization to speak with your mortgage servicer and coordinate the assumption process for you.

As the process progresses, we keep you up to date. By logging on to an online dashboard, you can see where it stands so that the transaction closes on time.

Harness the Power of Assumable Mortgages

Whether you want to sell your house or find your dream home, Roam can help. Our approach is comprehensive and user-friendly. We’re with you every step of the process, from qualification to purchase to simplify the assumption process.